Welcome to BAM Capital

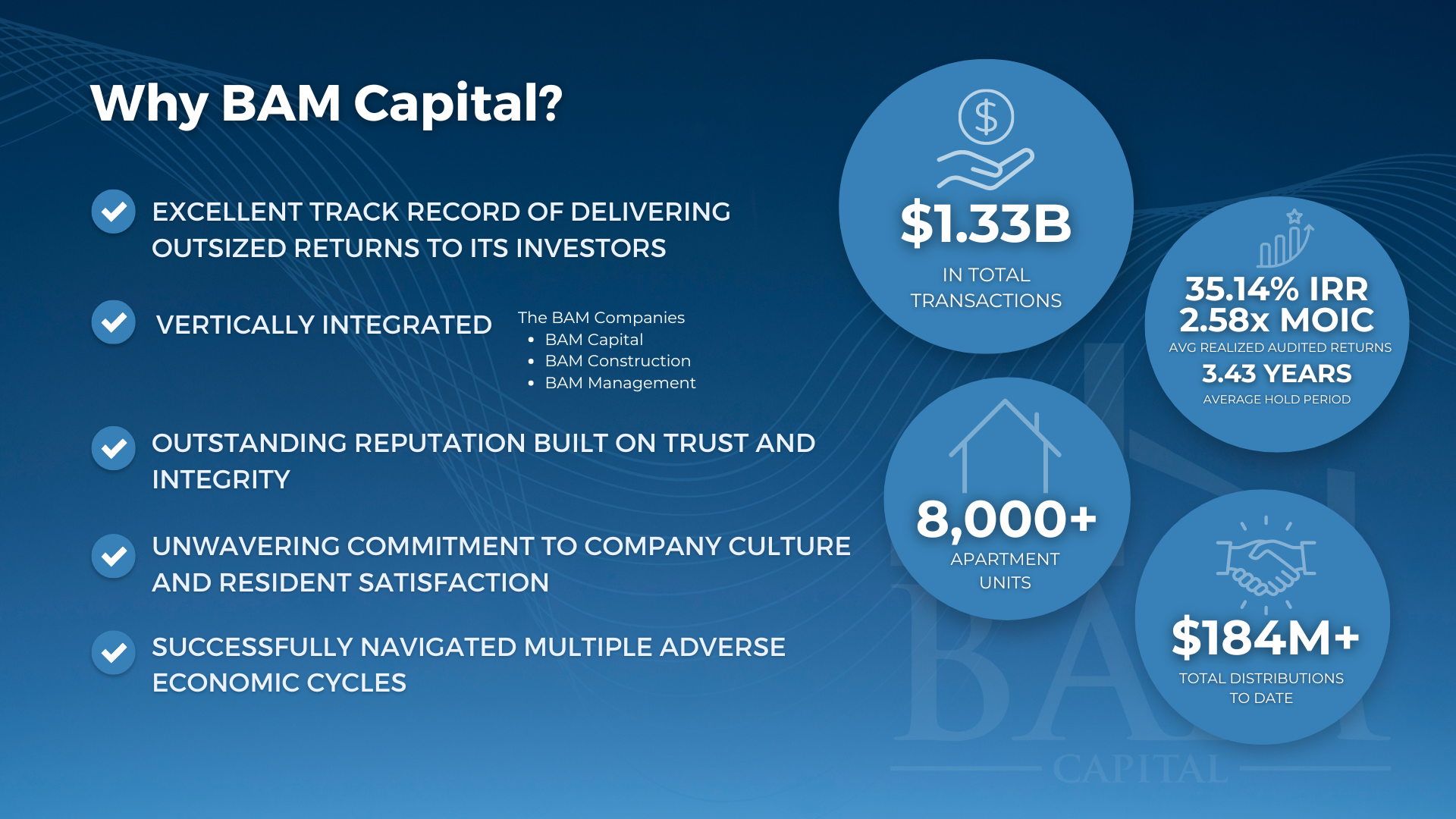

$1.33B+

In Transactions

2.58x

Equity Multiple

Averaged Realized Return

3.43 Years

Average Hold Period

Start Earning Passive Income

Current Offerings

Offering Memorandum – Fund IV

Offering Targets:

- 8% Monthly Distributions

- Preservation of Capital

- 12% Targeted Total Return

About:

Our BAM Preferred Credit Fund reflects our dedication to providing investment opportunities with a targeted 12% total return, while ensuring a strong focus on principal preservation. Our open-ended fund structure is designed for sophisticated investors with a focus on liquidity needs in today’s high-interest rate, uncertain environment.

Our investment strategy focuses on hand-selecting every asset, with a keen eye on the multifamily real estate sector, known for its resilience and strong performance. BAM Capital has its roots in real estate management and employs a large property management team with extensive history and training in order to optimize our residents’ experiences.

This open-ended investment opportunity aims for a fund size of $1 billion, targeting a solid 12% total return and 8% monthly distributions, reflecting our dedication to combining top-notch underwriting standards with deep local market and asset level insight.

Offering Targets:

- 3-5 Years Hold Period

- 2x-2.5x Equity Multiple

- 15-20% IRR

About:

The BAM Multifamily Growth & Income Fund IV, a private real estate fund, seeks to balance cash flow stability, capital preservation, and long-term capital appreciation while providing superior risk-adjusted returns to investors.

The strategies of Fund IV are:

- Acquire Class A & B assets that are located near major economic drivers. Focus on Midwest markets with strong demographics and quality school systems.

- Seek assets that have strong, consistent in-place cash flow in markets where there is a supply and demand imbalance. Keep cash flow stability, capital preservation, and long-term appreciation top of mind.

- Use the BAM Companies vertically integrated platform with proven processes to drive revenue and create operating efficiencies. Seek opportunities that can benefit from organic rent growth or select interior/exterior renovations to justify future rent increases.

- Eliminate “single asset risk” through portfolio diversification. The expectation that one or two assets may significantly outperform projections further increases the likelihood of a higher overall return for investors.

Given BAM Capital’s intimate knowledge of the Midwest apartment market, the management team has the highest level of conviction in its ability to execute the business plan and deliver the targeted returns to investors.

About BAM Capital

Indianapolis, IN

Headquarters

2010

Year Founded

Privately Held

Company Type

150+ Employees

Company Size

From Our Investors

I have many years experience as a financial Executive in Private Equity owned companies and am very impressed with the sharp, diligent, and methodical manner in which Ivan and his team run their businesses and work with their limited partners. I have invested in several projects and have been very satisfied with the results thus far.

My husband and I were looking for a profitable passive investment that would allow us peace of mind. We were impressed with BAM’s low-risk business model and the professionalism of their team. We chose to invest in the BAM Fund as a way to diversify our investment over multiple assets and have been pleased with the returns and timely reporting.

I have been very happy with Ivan and his team of professionals. I have experience with five other real estate companies in a similar investor role. In this type of limited partner relationship, timely reporting and transparency are key to instill confidence. BAM has met or exceeded my expectations. I plan to continue to invest with this team for the foreseeable future.