Understanding private equity in multifamily real estate

Private equity (PE) influences almost every industry earning money today. It affects everything from home services and medicine to even more unlikely spaces such as national rugby unions and the NFL.

Private equity represents one’s ownership (stake) in a private business. PE comes from firms run by general partners (GPs), also called sponsors. GPs raise capital from limited partners (LPs) or investors. In real estate private equity (REPE), these investors may include pension funds, insurance firms, endowments, family offices, and high-net-worth (HNW) individuals. Typically, the firm will focus on offices, retail, industrial, and multifamily properties. [1]

Private equity in multifamily real estate aims to create funds to acquire, manage, and (sometimes) sell multifamily real estate assets. This investment vehicle has become invaluable to those who have learned to mitigate its risks and is a unique way for investors to manage their income passively.

HISTORY OF PRIVATE EQUITY

Like many alternative asset classes of this ilk, private equity was born in the 80s, necessitated by a rise in leveraged buyouts. A leveraged buyout (LBO) is when one company acquires another mainly using borrowed money, either through a loan (debt) or equity (investments). [2]

Though hitting critical mass in the decade of decadence, many claim private equity’s roots trace back to the railroad era. When railroad manufacturers struggled to find funding via ultra-high-net-worth (UHNW) individuals (UHNWIs), they were bailed out by central investment banks that bought controlling interests and used their leverage to restructure business operations. One famous example of this is when JP Morgan Chase & Co. bought Carnegie Steel for $480 million near the turn of the 20th century, creating what was, at the time, the largest company worldwide: United States Steel. [3]

Private equity became a major player in real estate around the same time as the buyout boom as a way for investment firms to diversify their offerings through “real estate private equity funds.” [4] Like its present-day structure, real estate private equity funds allow firms to raise capital from institutional investors, sometimes at a discounted price.

Other industries have adopted private equity as a high-yield funding strategy. Tryon Medical Partners is considered the leading independent physician group in Charlotte, North Carolina. In 2018, they decided to leave their network and turn to private equity to usher in more equitable practices for their patients and to make more money doing it. [5]

The home service industry (HVAC, plumbing, electrical companies, etc.) has also adopted private equity in several cities nationwide. Known as “skilled trade businesses,” they are being purchased by PE firms that project substantial returns from the trades. [6]

Even the NFL has an interest in private equity. Earlier this year, NFL owners voted to allow a select group of private equity funds to purchase up to 10% of an individual NFL team. One Sports Business Journal article from August states, “The Dolphins are in advanced talks to sell a 10% stake to Ares Capital Management, the first known PE deal to be that close.” [7]

PRIVATE EQUITY IN MULTIFAMILY PRIVATE PLACEMENT

Multifamily private placement, sometimes called syndication, is a partnership. It occurs when multiple investors pool funds to buy a multifamily property. General partners (GPs) are responsible for executing the business plan, while limited partners (LPs) assume a passive role. Multifamily real estate consists of residential properties with two to four housing units and commercial properties with five or more housing units. So, a smaller building with fewer units, like a duplex, would be categorized as residential. However, a more sizeable operation like an apartment community would fall under commercial multifamily real estate.

Multifamily investment funds comprise equity investment positions in numerous multifamily properties. These properties are distributed using a real estate strategy called portfolio diversification; this is when several properties in various locations are placed into one fund, reducing risk and increasing the potential for returns. The returns are then divided among the investors. [8] As mentioned earlier, these properties may be in a single MSA (metropolitan statistical area) or various locations spanning several states. They may differ in class (A, B-, C, etc.), amenities, interiors, and exteriors. Some value-added strategies are intended to mitigate risks for investors with the purpose of increasing the property’s sale price. In this way, multifamily real estate funds can be a unique alternative for passive income investors. [9]

PRIVATE EQUITY RISKS

Investing in real estate private equity (funds) can be risky but has historically demonstrated 8% to 10% on returns. [1] Some of these risks are related to the fund’s financial structure, general market environment, debt, or liquidity. However, some more commonly encountered risks deal with the property itself. Knowing the history of each resident, having a deep knowledge of property operations, monitoring rent growth opportunities, and diligent, disciplined underwriting can effectively minimize property risks. [10]

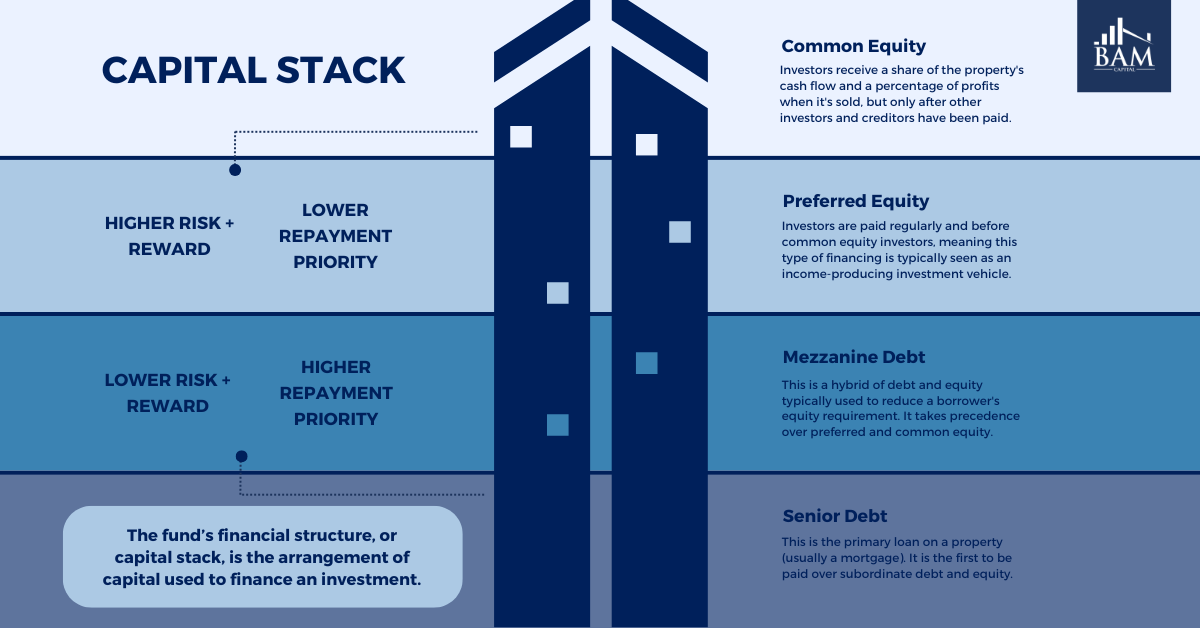

The fund’s financial structure, or capital stack, is the arrangement of capital used to finance an investment. Some capital stacks consist entirely of equity (ownership stakes for investors), while others consist almost completely of debt (loans from banks like mortgage-backed securities). Though the size of each section of the capital stack can vary, the debt/equity combination is an essential component of its structure. If compared to a ladder, debt would be on the bottom half (most secure), and equity would sit at the top (riskiest). The debt half would split into senior debt (mortgage) and maybe mezzanine debt (junior debt/small bridge loans to fill the gap between debt and equity). The equity half would split into common and preferred equity. Each position in the capital stack receives a priority rating: debt is prioritized over equity if the fund underperforms, and within the equity section, preferred equity investments take priority over common equity.

It may seem obvious why common equity investments are risky: If the asset or property underperforms, investors in this equity position face a more substantial loss. Common equity investors typically see returns once an asset sells, which can be risky for those unable to wait years to recoup. However, preferred equity investments carry the risk of less substantial returns. And if the asset underperforms, they’re prioritized over common equity investments for repayment. [10] Visit BAM Capital’s Insights page to view what a capital stack can look like.

No investment is without risk. However, most private equity firms acknowledge these risks and adopt mitigation strategies.

BAM PREFERRED CREDIT FUND: SUPERIOR RISK-ADJUSTED YIELDS AND CAPITAL PRESERVATION TO QUALIFIED PURCHASERS

The BAM Preferred Credit Fund is designed to provide investors with stable, above-average risk-adjusted income by making preferred equity investments in apartment communities and acquiring securities with a higher rate of return. Preferred equity investments offer investors a share of ownership in a real estate deal or entity. Some of the unique advantages BAM Capital seeks for investors in this fund include:

Monthly cash flow or distribution reinvestment

Semi-liquidity and tax efficiency

Securitization with institutional assets

Safeguarding against market volatility

The BAM Preferred Credit Fund caters to those who comprehend the pivotal role of strategic investment in amassing wealth. It strives to honor liquidity preferences by offering an option for redemption, which provides an added layer of convenience and control over investment decisions.

Review the Offering Memorandum to learn more about BAM Capital’s track record and gain access to exclusive webinars.

CONNECT WITH AN INSTITUTIONAL REAL ESTATE OWNER/OPERATOR

BAM Capital prioritizes accredited investors who want to enjoy passive income and all the other benefits of multifamily private placement. As the private equity arm of The BAM Companies, BAM Capital focuses on high-quality Class A multifamily real estate, seeking properties with in-place cash flow and proven upside potential. This Indianapolis-based owner/operator’s investment strategy creates forced appreciation while mitigating investor risk. Today, the brand has over $1.2 billion in AUM and ~6,500 apartment units.

Remember that no investment is without risk. Before making financial decisions, consult your investment advisor and schedule a call with a BAM Capital investment team member.

Disclaimer: All investments carry risk, including potential loss of capital. This content is for informational purposes only and is not financial, legal, or investment advice, nor an offer or solicitation to buy or sell any security. Consult an independent advisor for personalized guidance, and contact BAM Capital for details on current offerings. BAM Capital, its affiliates, and its representatives are not fiduciaries or investment advisors. The information provided is general and may not reflect individual financial goals. Past performance does not predict future results. BAM Capital and its affiliates do not guarantee the accuracy or completeness of this information.

Sources:

[1]: Investopedia. (27 March 2022). “Private Equity Real Estate: Definition in Investing and Returns.” https://www.investopedia.com/terms/p/private-equity-real-estate.asp

[2]: Investopedia. (8 June 2024). “Leveraged Buyout (LBO): Definition, How It Works, and Examples.” https://www.investopedia.com/terms/l/leveragedbuyout.asp#:~:text=A%20leveraged%20buyout%20(LBO)%20is,used%20as%20leverage%20against%20it.

[3]: Financial Poise. (2 August 2022). “What is Private Equity? A Brief History.” https://www.financialpoise.com/what-is-private-equity-a-brief-history/

[4]: The Wharton School. (2002). “Real Estate Private Equity Funds.” https://realestate.wharton.upenn.edu/working-papers/real-estate-private-equity-funds/#:~:text=Created%20in%20the%20late%201980s,%2Dbe%2Ddefined%20performance%20standards.

[5]: North Carolina Health News. (9 October 2024). “Docs Who Ditched Atrium Now Partnering with Private Equity.” https://www.northcarolinahealthnews.org/2024/10/09/tryon-medical-partnering-with-private-equity/#:~:text=Six%20years%20after%20breaking%20away,help%20them%20reach%20more%20patients.

[6]: Morning Brew. (13 October 2024). “Private Equity Wants to Unclog Your Toilet.” https://www.morningbrew.com/daily/stories/2024/10/13/private-equity-wants-to-unclog-your-toilet

[7]: Sports Business Journal. (16 October 2024). “Clark Hunt: Initial NFL P.E. Deals May Not Close in ’24.” https://www.sportsbusinessjournal.com/Articles/2024/10/16/nfl-private-equity-clark-hunt?publicationSource=sbd&issue=bd48b19d52734640bec54ff7fd658853

[8]: Trion Properties. (n.d.). “What is a Multifamily Fund?” https://trionproperties.com/real-estate-investment-education/articles/multifamily-investment-fund/

[9]: BAM Capital. (26 September 2021). “What You Need to Know About Investing in Multifamily Real Estate Funds.” https://capital.thebamcompanies.com/multifamily-real-estate-funds-investing/

[10]: Smartland. (19 May 2021). “Top 10 Risks to Consider Before Investing in Private Equity Real Estate.” https://smartland.com/resources/private-equity-risks/