Top 5 Predictions for Multifamily Real Estate in 2024

For the first time in its history, BAM Capital is making predictions for the multifamily market. The current economic and geopolitical environment makes this task a significant challenge, but it’s important that current and potential investors understand BAM Capital’s perspective on the market. There is no crystal ball. One can only take the important lessons learned in the past to better prepare for the future.

The U.S. apartment market saw its challenges last year with rising interest rates, higher operating costs, and new supply that reached a 36-year high. This year will present similar challenges, especially with new supply; however, it appears interest rates will stabilize, and inflation will continue to cool. More importantly, certain trends are starting to materialize that underscore the long-term health of apartment fundamentals.

New Supply Will Peak in 2024 But Unit Starts Come to a Grinding Halt

It’s essential to differentiate new supply from unit starts. Deliveries will hit a 50-year peak in 2024, while unit starts will come to a grinding halt. New supply will garner plenty of attention this year, but don’t underestimate this halt in construction and the positive impact on multifamily fundamentals long-term. Demand isn’t going away anytime soon.

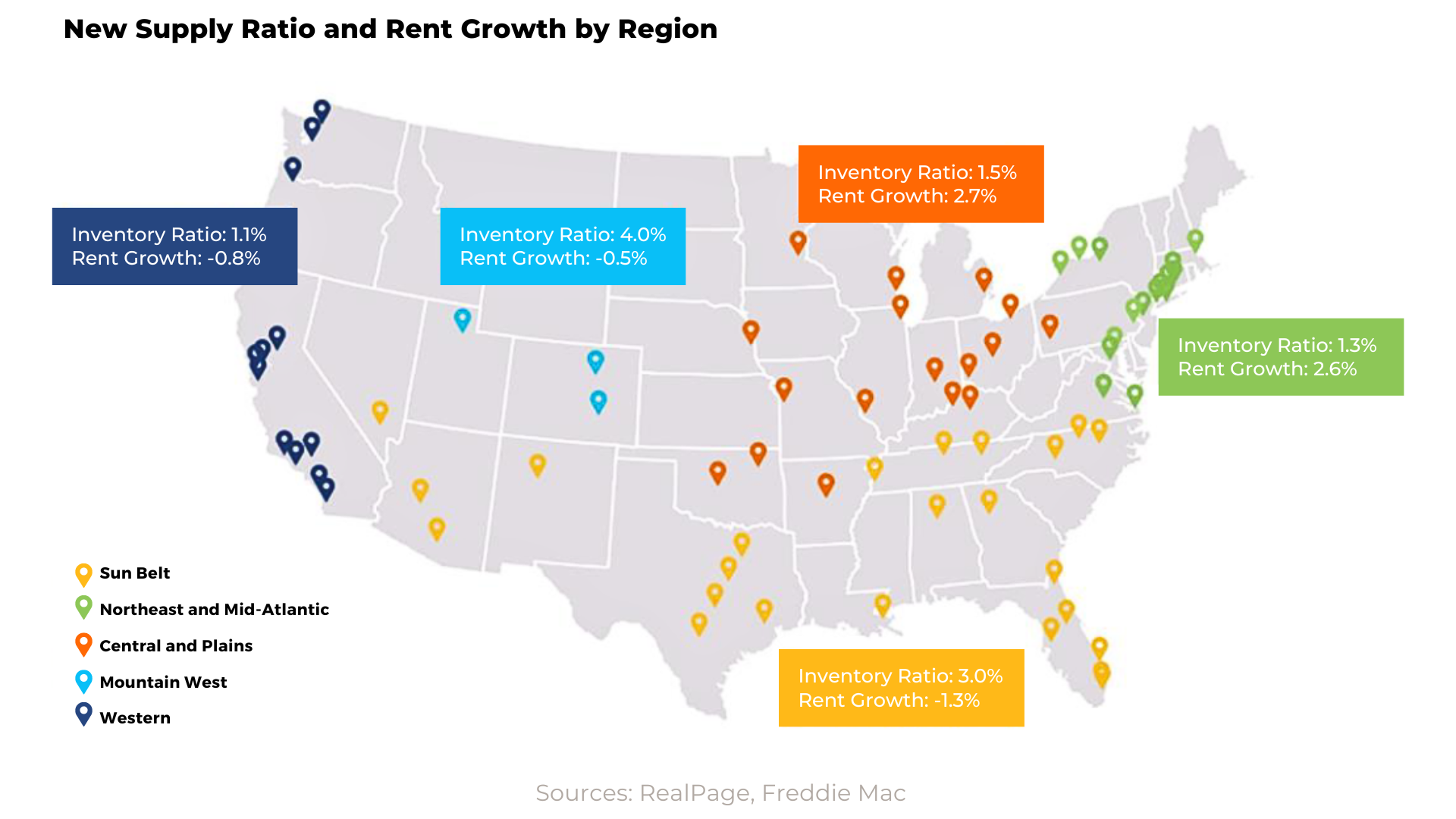

According to RealPage, there will be a staggering 50 – 55k units per month delivered nationally in 2024. Most of this development will be concentrated in the Sunbelt and West Coast, which will present leasing challenges for developers as these groups compete for residents amid higher vacancies and stagnant rents. While deliveries will hit a peak, unit starts have decreased to roughly 25k units per month and are trending downward largely due to a pullback in construction loans and developments that don’t pencil. This statistic cannot go unnoticed. While it won’t show its face in 2024, there will be a positive impact on apartment fundamentals in 2025 and beyond when the pendulum will swing back to owners/operators in a low-supply environment.

Apartment Fundamentals Will Remain Healthy

Multifamily fundamentals moderated in 2023, largely due to the high new supply entering select markets. Rent growth saw nominal gains, while occupancy rates continued their downward trend back to the historic norm. According to Freddie Mac, rent growth among Class A apartment communities showed the most significant gain at 0.9% as of October 2023 despite the large increase in new supply (roughly 470k units). Rent growth for Class B and C properties was negative at -0.2% and -0.4%, respectively. The occupancy rate for all apartment communities was approximately 94.3%.

It should be noted that Class C properties saw the most significant decline in occupancy at 160 basis points (“bps”), roughly 2x the decline in Class A and B properties.

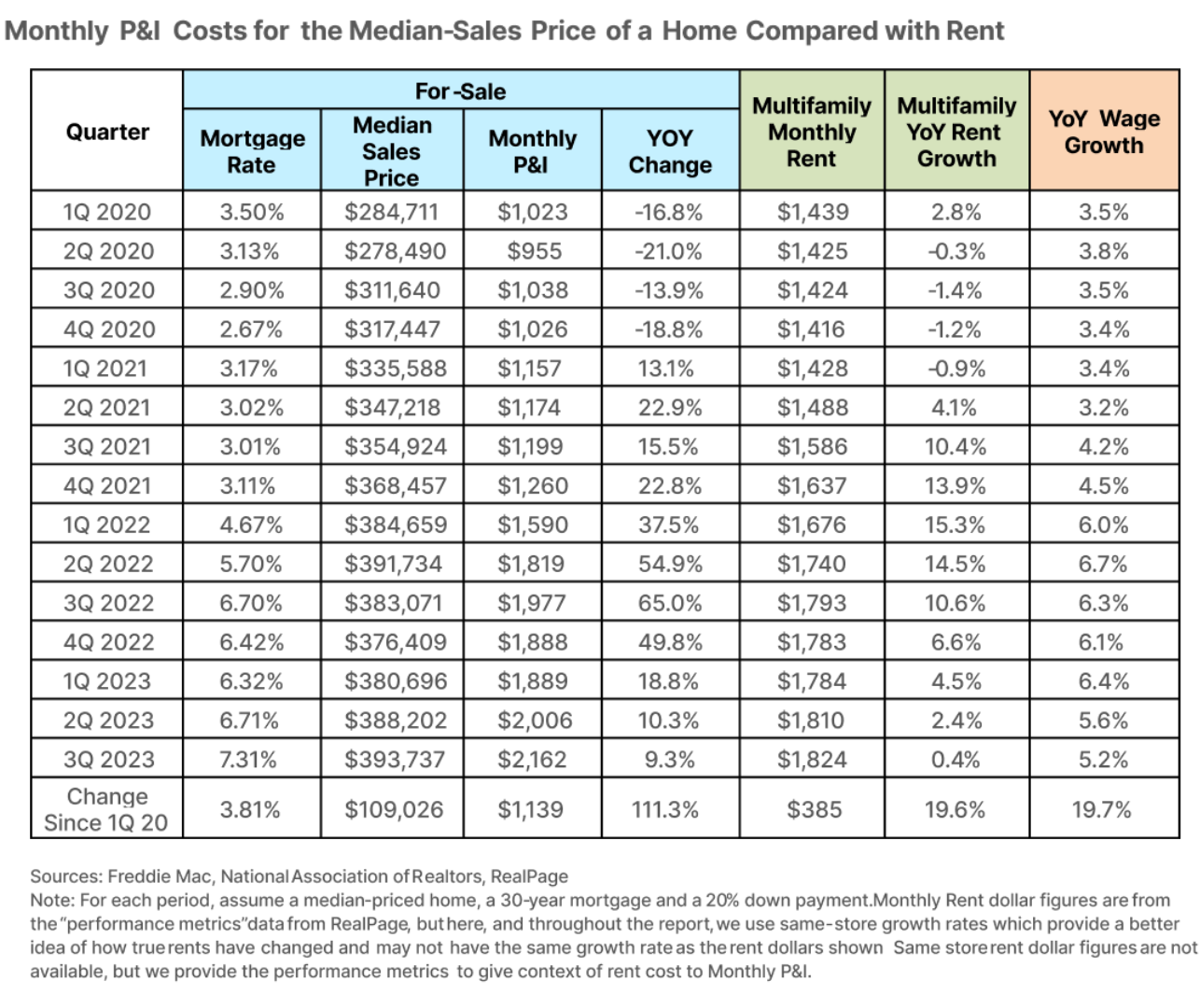

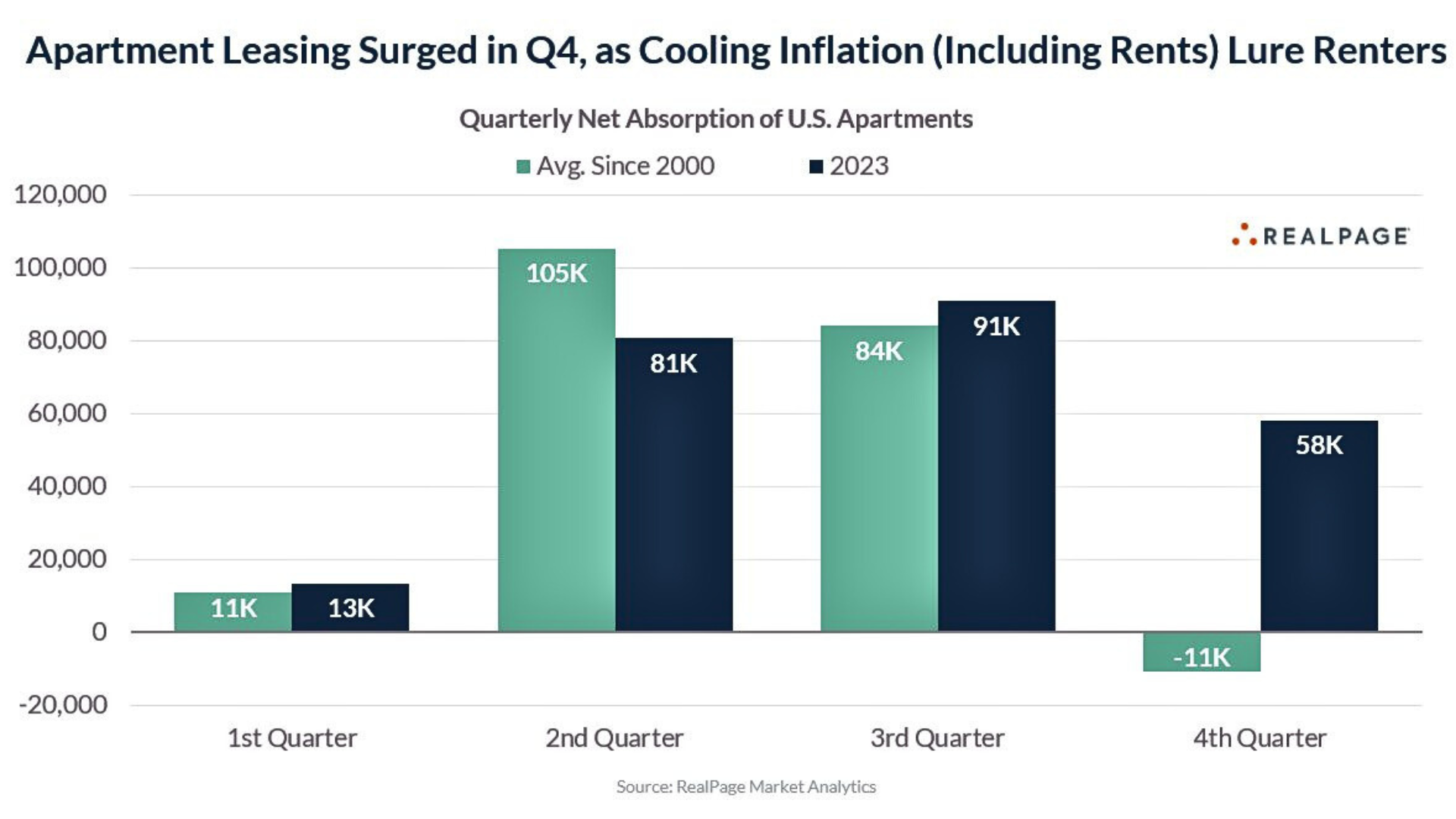

Expect much of the same as deliveries will peak in 2024 at approximately 670,000 units. Rents and occupancies in select markets such as the Sunbelt and Mountain West will continue to moderate while the Midwest and Northeast, where new supply relative to existing inventory is still below the national average, will continue to see modest gains in the same categories. While new supply will receive a majority of the headlines in 2024, there is still plenty of demand for apartments driven by the significant price discrepancy between renting and owning along with Generation Z (25% of the U.S. population) entering their prime renting age. According to RealPage, apartment demand saw positive net absorption of 58,200 units in the 4th quarter of 2023, which was the 3rd best 4th quarter in 25 years. Strong demand is a great sign going into 2024. Make no mistake – demand won’t keep pace with new supply, but it will be enough to soften the blow to apartment fundamentals from a national perspective.

Multifamily Distress Will Be More Sporadic Than Widespread

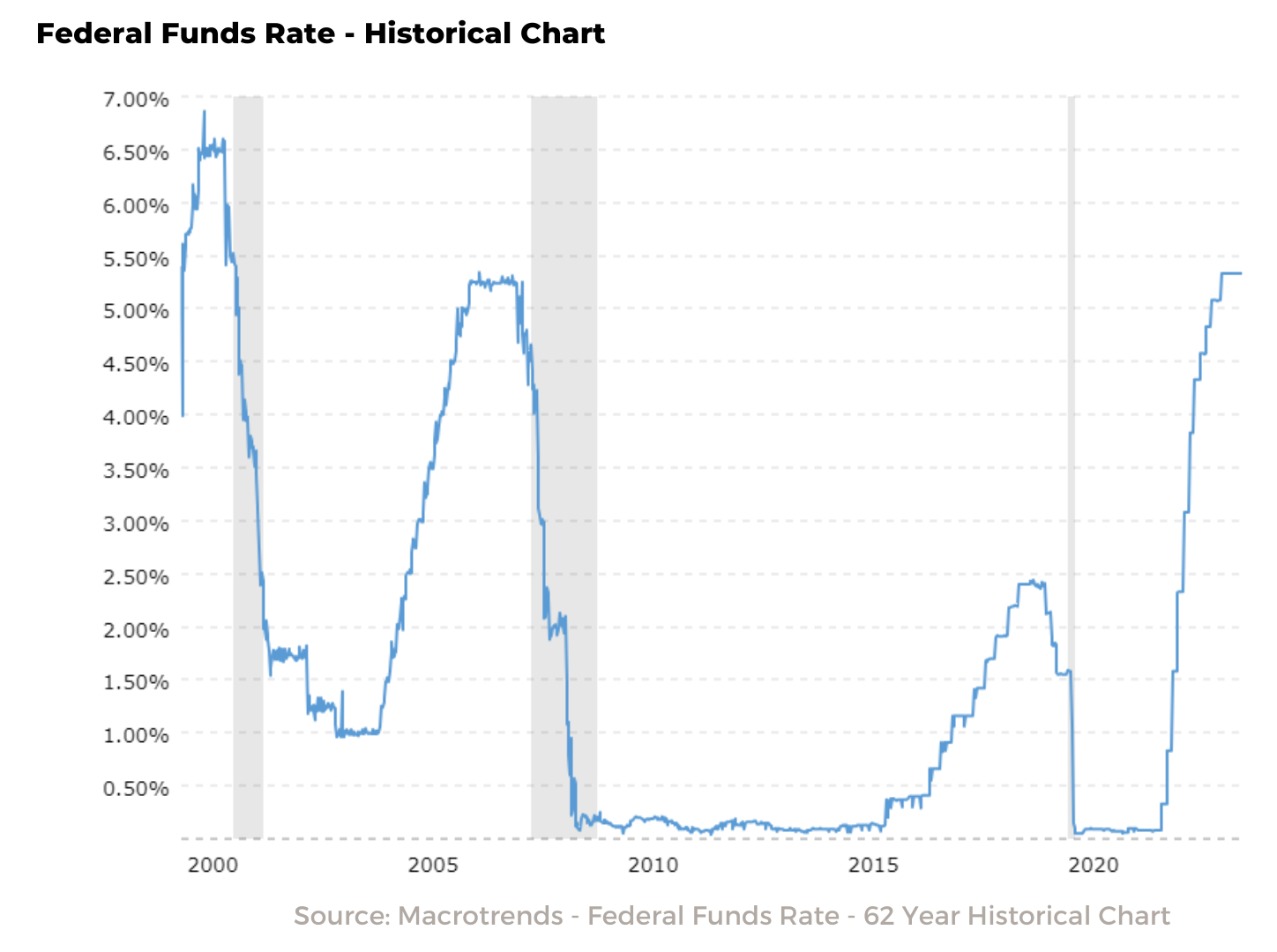

According to the Mortgage Bankers Association, there is nearly $2.7 trillion in CRE debt maturing by 2027. Of this amount, roughly $1 trillion is associated with multifamily properties. Many of these loans originated in 2020 and 2021, when interest rates were at historic lows. Since then, the central banks unleashed the steepest series of interest-rate increases in decades during 2022 and 2023 to stymie inflation, which caused a rise in cap rates. This rise will undoubtedly cause valuation issues upon loan maturity for certain sponsors that maximized leverage on acquisitions under the guise of an ultra- aggressive business plan with low quality assets. If the proforma net operating income isn’t achieved upon loan maturity, the new loan won’t be enough to pay off the existing loan since borrowers are constrained by Loan to Value (“LTV”) and the Debt Service Coverage Ratio (“DSCR”).

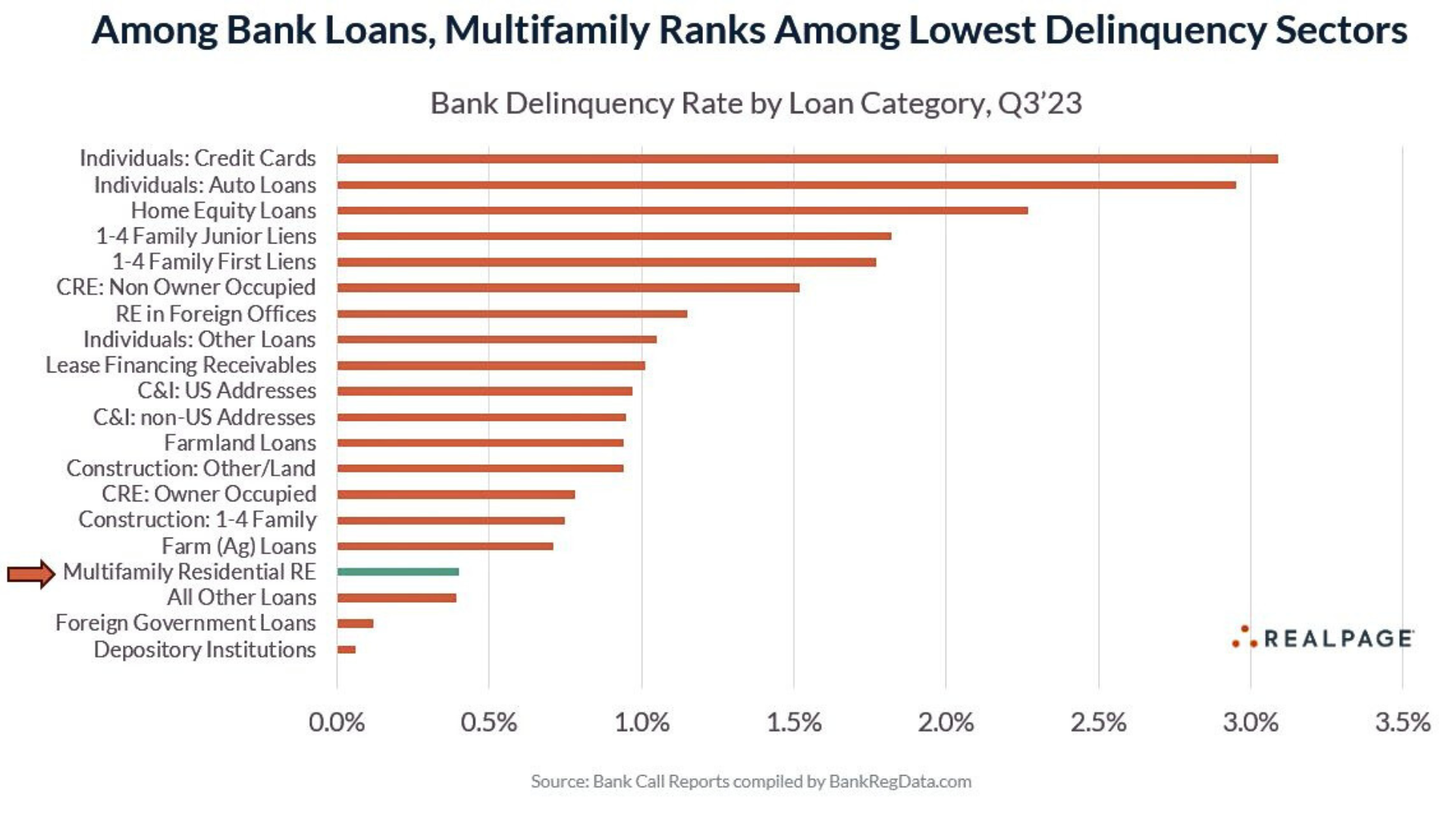

Expect the sporadic distress to occur with inexperienced sponsors/borrowers that acquired Class B and C assets situated in tertiary locations with subpar demographics. If the sponsor has failed to execute their business plan and didn’t have ample cash reserves to cover the downside risk, the borrower will have two options: 1) sell at a potential loss or 2) invest additional capital to cover the delta between the existing loan and new loan. There might be some opportunities in the Class A space, but fundamentals have remained healthy despite the high supply environment. Additionally, private equity has been actively raising “rescue capital” in the form of preferred equity to cover this potential shortfall between the new loan and the existing one. It should be noted that the delinquency rate on all multifamily loans was less than 1% as of Q3-2023 according to BankRegData.com.

Interest Rates will Remain High but Stabilize

The Federal Reserve’s “higher for longer” mantra will remain in effect throughout 2024. However, some investors feel bullish that the Fed will begin cutting interest rates in the first half of this year. That might be the case. But the Fed can cut interest rates by more than a percentage point, and the mantra of “higher for longer” still holds water. The effective federal funds rate is now in the range of 5.25 – 5.50%. The rate futures indicate this rate will be lowered to approximately 4% by the end of 2024. A rate of 4% would still be higher than the funds rate seen since 2008 and by a wide margin.

The silver lining here is that interest rate stability should help drive transaction volume, which was down +/-75% in 2023. With the meteoric rise in interest rates, price discovery was a serious issue for buyers and sellers who simply couldn’t agree on price. The stabilization of the interest rates should help buyers and sellers find the middle ground to get transactions across the finish line.

Multifamily Remains the Darling Child of Real Estate for Investors

As mentioned, there is no dearth of debt and equity sitting on the sidelines waiting to pounce on acquisition opportunities. Why? One reason is housing is an essential need. While supply is currently outpacing demand, the U.S. faces a pressing need to build 4.3 million new apartments by 2035, according to a recent study commissioned by the National Apartment Association (NAA) and the National Multifamily Housing Council (NMHC). The 4.3 million apartment homes needed includes an existing 600k apartment home deficit because of underbuilding during the 2008 financial crisis. This supply/demand imbalance will have a positive impact on long- term market fundamentals.

Another important consideration is that multifamily simply provides the best risk-adjusted return of any real estate asset class. Cash flow stability, capital preservation, and long-term appreciation potential epitomize the benefits of multifamily investment. Additionally, market-rate apartments are arguably the most liquid asset class in real estate. Liquidity is an essential factor for many groups that might need to sell or refinance.

Multifamily has stood the test of time and has long been considered the darling child of real estate. This opinion won’t change in 2024 as more buyers come off the sideline to compete for well-positioned properties. As mentioned, expect higher transaction volume this year as interest rates stabilize and price discovery is less of an issue.

It’s no secret to investors that the returns of multifamily have outpaced the returns of the S&P for the past 25 years. The sector rarely disappoints.

Author: Tony Landa, Chief Investment Office, The BAM Companies, January 2024