How BAM Capital Creates Positive Leverage

Table of Contents

Investors often ask about in-place cap rates on BAM Capital’s acquisitions relative to current interest rates. This relationship tells investors if BAM Capital is creating positive or negative leverage on these investments. While this question is fair, it doesn’t tell the whole story.

Cash Flow In Real Estate

Real estate is a cash flow business. The trick is to underwrite a property not on in-place cash flow, but on stabilized cash flow. This calculation gives us a stabilized cap/yield, which is the most important metric when evaluating real estate. Not only is this metric important relative to current interest rates, but it gives us the intrinsic value of the property.

In-Place Cap Rate & Stabilized Cap/Yield

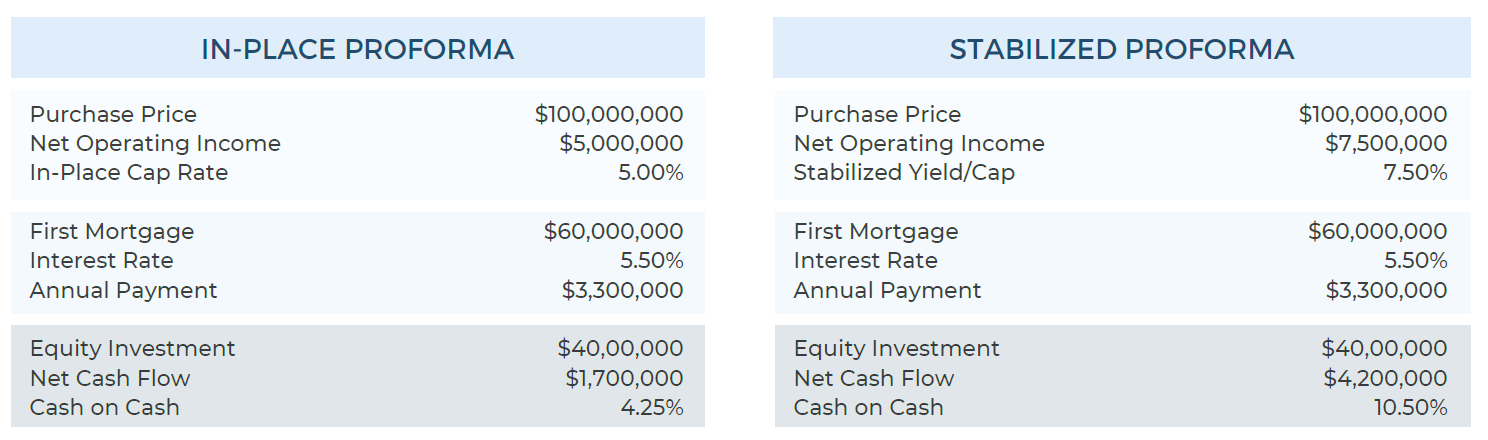

Below are two scenarios that display the difference between an in-place cap rate and a stabilized cap/yield with the corresponding cash-on-cash yield. Let’s look at the in-place proforma. BAM Capital purchases a property for a 5% cap rate and borrows money from a lender for 5.5%. This relationship represents negative leverage (in-place cap rate < interest rate) as it yields an initial levered cash-on-cash return of 4.25%. Does this initial below average return make the deal bad? The answer is unequivocally no.

Now let’s fast forward to the stabilized proforma showing the stabilized cap/yield relative to the interest rate. BAM Capital acquires a property at a 5% cap rate that is underperforming the market (rents below market, occupancy struggles, above market operating expenses, etc.). All other assumptions being equal, BAM Capital executes its business plan and takes net operating income from $5 million to $7.5 million. This equates to a stabilized cap/yield of 7.5% compared to the interest rate of 5.5%. This relationship is called positive leverage (stabilized yield > interest rate) as it now yields a levered cash-on-cash return of 10.50%. Not a bad deal after all.

How BAM Capital Creates Investment Opportunities For Real Estate Investors

This example clearly illustrates why the stabilized yield is critical to current interest rates. More importantly, the stabilized yield is paramount to the market cap rate, which creates real value for our investors. In the above example, the stabilized yield is 7.5%, and the market cap rate is 5.5%. This 200-basis point spread is all profit. Said another way, BAM Capital acquires a property for $100 million with $5 million in net operating income (5.0% cap rate). BAM Capital increases the net operating income to $7.5 million (7.5% stabilized yield). BAM Capital sells for a 5.5% cap rate on $7.5 million of net operating income ($136 million), which produces a levered equity multiple close to 2.0x. So, while the initial cash-on-cash yield wasn’t appealing, the overall investment delivered healthy returns to the investor. That’s the BAM Capital advantage. Learn why BAM Capital is the #1 multifamily syndication investment company.

Author: Tony Landa, Chief Investment Office, The BAM Companies